Ultimate Guide to CPA Services for Startups in Arizona

Startups in Arizona face a dynamic landscape where innovation meets financial hurdles, with the state’s tech-savvy communities, high growth rates, and supportive ecosystem amplifying both opportunities and risks.

According to the StartupBlink Global Startup Ecosystem Report, Arizona ranks #53 globally in 2025 with 739 active startups, securing $659 million in funding so far this year—a 54% increase from 2024, driven by Phoenix’s emergence as a hub for software and healthcare tech. However, the U.S. Bureau of Labor Statistics notes that 20.8% of new businesses fail in their first year, often due to tax mismanagement, poor financial planning, and overlooked incentives like Arizona’s R&D tax credits.

In Phoenix alone, over 500 new ventures launch annually, but many struggle with compliance in a state where transaction privilege taxes and federal obligations can erode early profits. Startups are particularly vulnerable to cash flow issues, with 50% failing within five years per Exploding Topics data, exacerbated by missing deductions or entity missteps that lead to audits or penalties. Arizona’s laws offer robust incentives for emerging businesses, including credits for research activities and small business grants, making expert guidance essential for survival and scaling.

As a CPA firm dedicated to empowering Arizona entrepreneurs, Chaston Liberty has assisted numerous startups in navigating these challenges, securing tax savings, optimizing structures, and achieving sustainable growth through tailored services. This comprehensive guide explores the unique financial risks for startups, Arizona’s key tax incentives, the role of CPAs in early-stage success, entity selection strategies, common pitfalls, funding preparation, statistics, anonymized case examples, and support resources. By arming founders with this knowledge, we aim to boost success rates and foster innovation.

Note: This information is for educational purposes only and is not financial or legal advice—consult a qualified CPA for your startup’s specific situation.

For specialized insights into growth-phase consulting, refer to our related page, Coach-Consultant Growth Services.

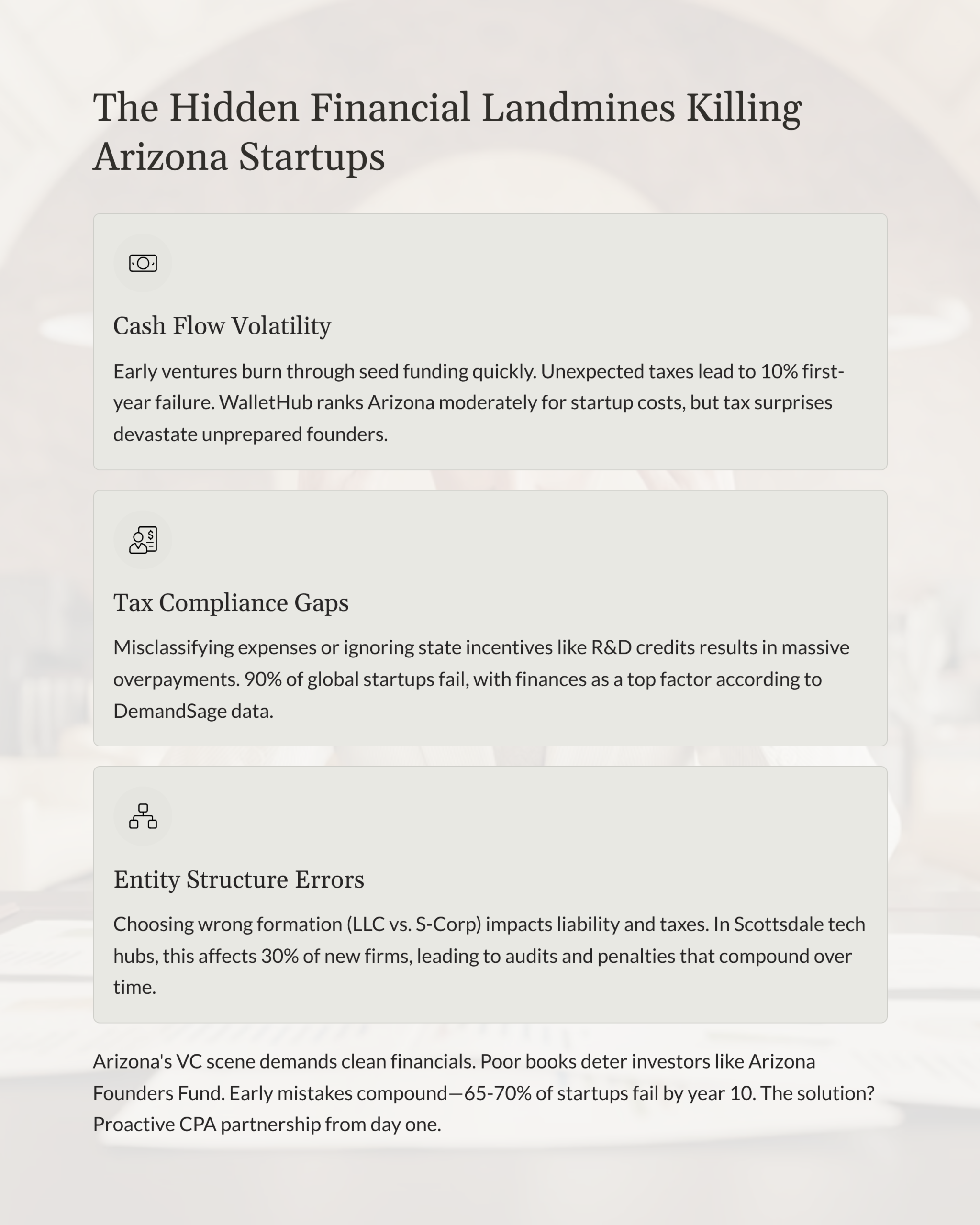

The Unique Financial Risks for Startups in Arizona

Startups encounter amplified risks from rapid scaling, limited resources, and regulatory complexities, making proactive financial management crucial in Arizona’s competitive ecosystem. The Greater Phoenix Economic Council (GPEC) reports that software startups, comprising 27% of deals, face peak challenges in Q1 2025 due to funding volatility. Key risks include:

- Cash Flow Volatility: Early ventures often burn through seed funding quickly; WalletHub ranks Arizona moderately for business startup costs, but unexpected taxes can lead to 10% first-year failure per BLS.

- Tax Compliance Gaps: Misclassifying expenses or ignoring state incentives like R&D credits results in overpayments; DemandSage show 90% of global startups fail, with finances as a top factor.

- Entity and Structure Errors: Choosing the wrong formation (e.g., LLC vs. S-Corp) impacts liability and taxes; in suburban hubs like Scottsdale, this affects 30% of new tech firms.

- Funding and Investor Scrutiny: Poor books deter investors; Arizona’s VC scene, with funds like Arizona Founders Fund, demands clean financials.

- Long-Term Impacts: Early mistakes compound, leading to audits or stunted growth; 65-70% fail by year 10 per EvryThink.

Local data from GPEC highlights Phoenix parks like Encanto as networking spots, but economic heat in summer slows deals. For related risks, see our article Heat-Related Factors in Business Cash Flow: Managing Seasonal Dips in Arizona. StartupBlink ecosystem overview: StartupBlink Phoenix Startup Ecosystem. Arizona Tax Incentives for Startups Arizona’s framework incentivizes innovation with credits and grants tailored for small businesses.

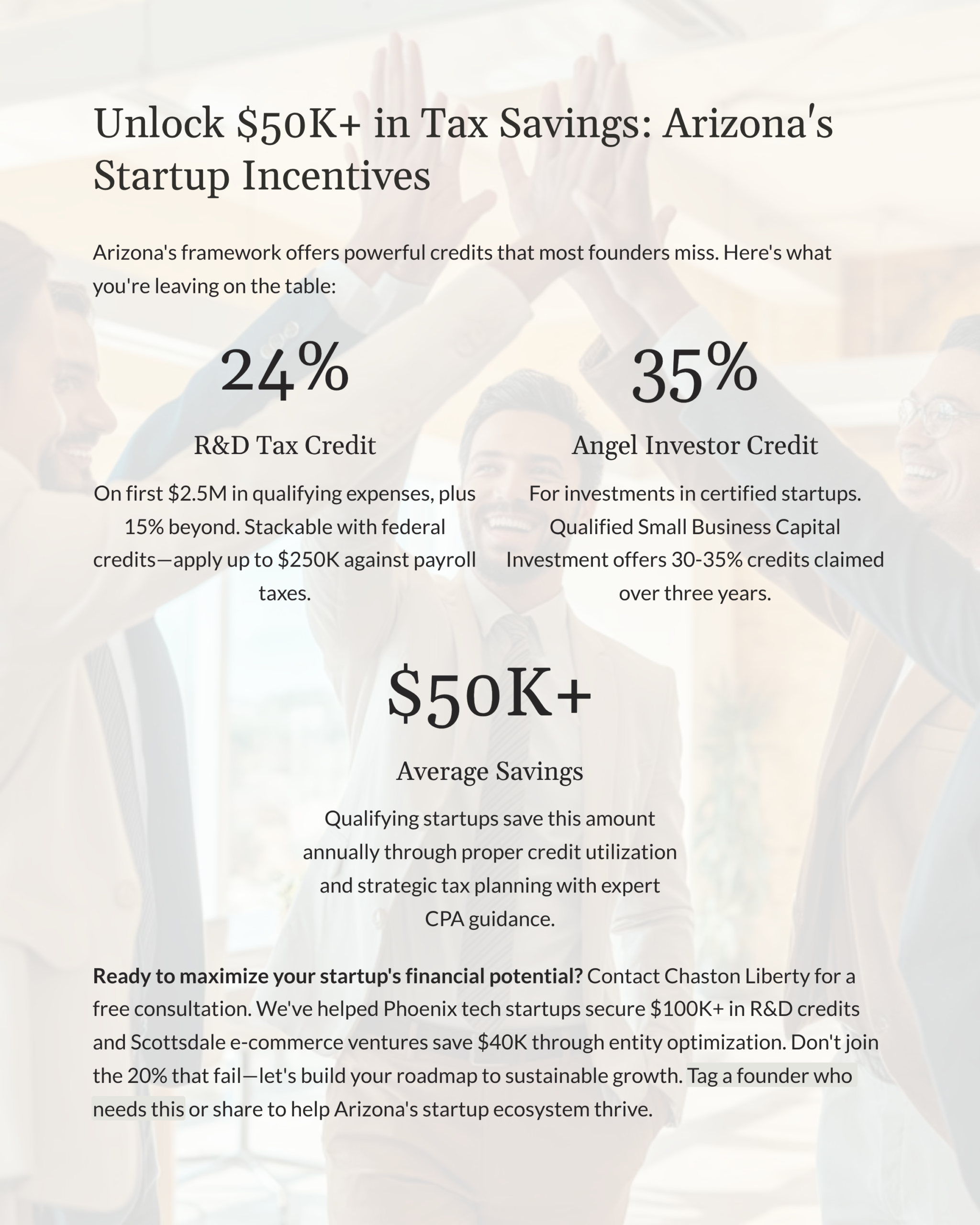

- R&D Tax Credit (ARS 41-1505): Offers 24% on the first $2.5 million in qualifying expenses plus 15% beyond, stackable with federal credits; startups can apply against payroll taxes up to $250,000.

- Qualified Small Business Capital Investment Incentive: 30-35% credits on investments, claimed over three years.

- Angel Investor Tax Credit: Up to 35% for investments in certified startups.

- No Damage Caps on Incentives: Enhances recovery for R&D-focused ventures.

- Extended Filing Periods: Flexible for emerging businesses.

These can yield average savings of $50,000+ for qualifying startups. For details, Research and Development Tax Credit Program: AZ Commerce R&D Credit. Full ARS 41-1505: Arizona Legislature ARS 41-1505.

The Role of CPAs in Startup Success in Arizona

Hiring a CPA streamlines compliance and strategy from day one.

- Entity Selection: Advise on LLC, S-Corp for tax benefits.

- Tax Planning: Maximize credits like R&D; quarterly reviews prevent surprises.

- Bookkeeping Setup: Implement tools for accurate tracking.

- Funding Prep: Clean financials for investors.

- Compliance Filing: Handle state and federal requirements.

- Growth Forecasting: Budgets and projections.

- Audit Defense: Representation if needed.

For more, see Your Roadmap to Startup Entity Selection in Phoenix. We offer contingency-based reviews focused on future savings.

Common Tax Mistakes for Startups and How to Avoid Them Avoid these pitfalls:

- Missing R&D Claims: Claim early; use software tracking.

- Mixing Personal/Business Finances: Separate accounts.

- Ignoring Deadlines: Set reminders for quarterly taxes.

- Overlooking Deductions: Track home office, travel.

- Misclassifying Workers: 1099 vs. W-2 clarity.

BLS startup stats: BLS Business Failure Rates. Statistics on Startups in Arizona National: 90% fail overall (Exploding Topics). Arizona: 739 startups, $659M funding in 2025 (GPEC), with 20% first-year failure. GPEC startup data: Greater Phoenix Economic Council Startups. Case Examples

- Phoenix Tech Startup: Overlooked R&D; we secured $100,000 credit, enabling Series A.

- Scottsdale E-Commerce: The Entity switch saved $40,000 in taxes.

Resources for Arizona Startups

AZ Commerce grants, GPEC hubs, and StartupBlink reports.

Conclusion and Call to Action

Arizona’s ecosystem favors prepared startups, but expert CPA guidance is key.

Ready to get started?

Contact Chaston Liberty CPA or call us at (480) 590-0968. You can also email Jim Chaston at jim@chastonliberty.com.

Let’s build a smarter tax strategy together—one that protects your business and fuels your success.