CPA for Early-Stage Startups: Tax Credits and More

Early-stage startups in Arizona navigate a high-stakes environment where bootstrapping meets opportunity, with the state’s innovation incentives and Phoenix’s funding surge offering lifelines amid failure risks. Per Fundraise Insider, Arizona startups raised $531.6 million in Q2 2025 across 44 deals, a 54% jump, but BLS data shows 20% fail in year one due to tax oversights.

In Phoenix, healthcare tech ventures lead with 16 deals, yet many miss credits like R&D, leading to cash crunches; DemandSage reports 10% global first-year failure tied to finances. Early startups are prone to underreporting qualifying expenses, resulting in lost savings and IRS scrutiny. Arizona provides targeted credits for R&D and investments, easing burdens for vulnerable new ventures. As specialists in startup CPA services, Chaston Liberty has guided early-stage founders to claim thousands in credits, structure efficiently, and avoid pitfalls for long-term viability.

This article delves into early-stage risks, Arizona’s credits, CPA strategies, prevention tips, injury-equivalent financial wounds, stats, cases, and resources.

Note: This information is for educational purposes only and is not financial or legal advice—consult a qualified CPA for your startup’s specific situation. For broader insights, refer to our pillar page Ultimate Guide to CPA Services for Startups in Arizona.

The Unique Risks for Early-Stage Startups in Arizona

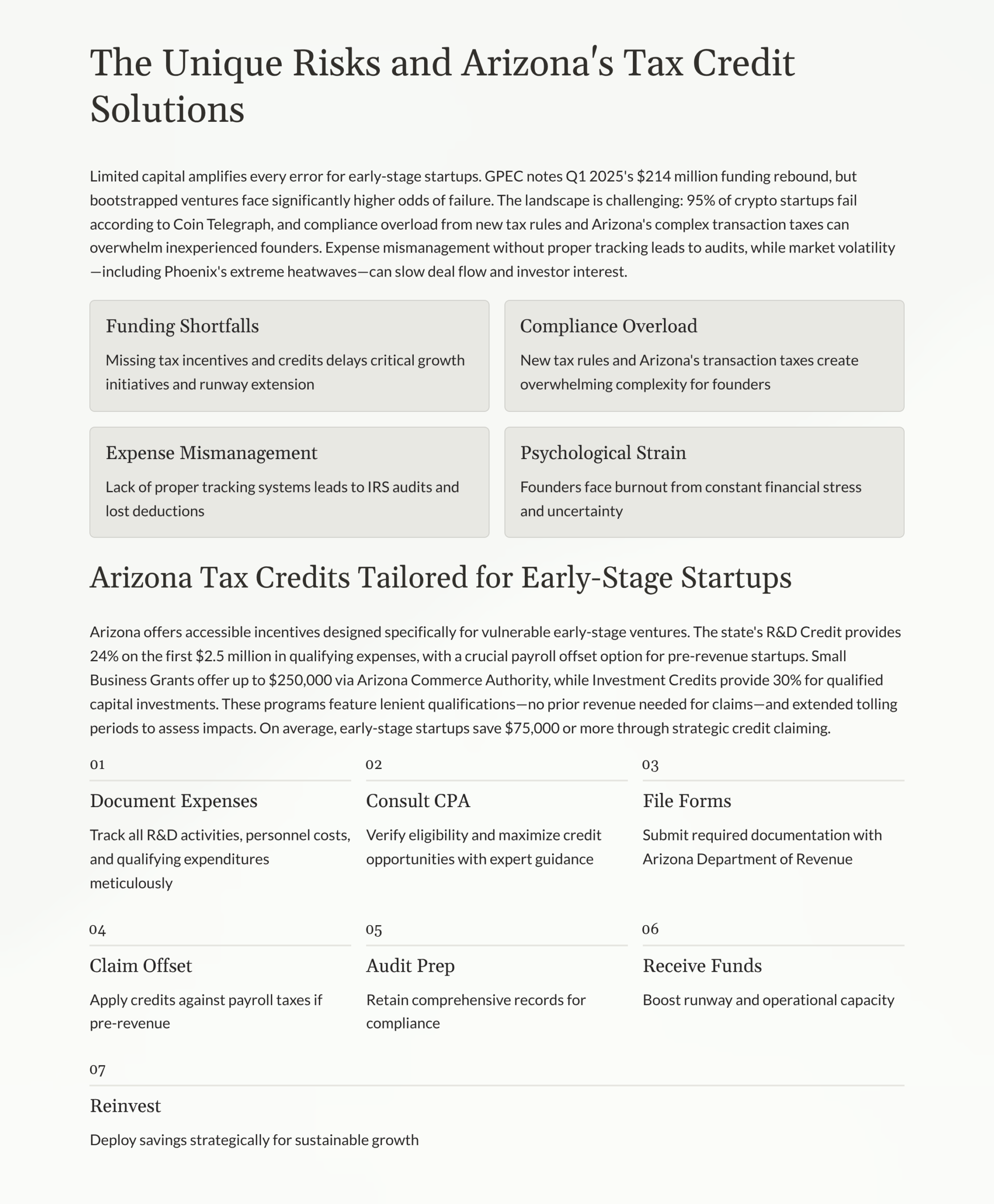

Limited capital amplifies errors; GPEC notes Q1 2025’s $214M funding rebound, but bootstrappers face higher odds. Key risks:

- Funding Shortfalls: Missing incentives delays growth; 95% crypto startups fail per Coin Telegraph.

- Compliance Overload: New tax rules overwhelm; Arizona’s transaction taxes add complexity.

- Expense Mismanagement: No tracking leads to audits.

- Market Volatility: Heatwaves slow Phoenix deals.

- Psychological Strain: Founders face burnout from financial stress.

For overlaps, Wild Funding Encounters in Arizona: Navigating VC Pitfalls. Boast.AI R&D insights: Boast.AI Arizona R&D Credits.

Arizona Tax Credits Tailored for Early-Stage Startups

Focus on accessible incentives:

- R&D Credit: 24% on first $2.5M; payroll offset for startups.

- Small Business Grants: Up to $250K via AZ Commerce.

- Investment Credits: 30% for qualified capital.

- Lenient Qualifications: No prior viciousness needed for claims.

- Extended Tolling: Time to assess impacts.

Averages $75K+ in early savings. For details, Swanson Reed AZ R&D Explained: Swanson Reed Arizona R&D Tax Credit.

The Claims Process for Early-Stage Tax Credits in Arizona Streamlined for newbies:

- Document Expenses: Track R&D activities.

- Consult CPA: Verify eligibility.

- File Forms: With AZDOR.

- Claim Offset: Against payroll if no income.

- Audit Prep: Retain records.

- Receive Funds: Boost runway.

- Reinvest: For growth.

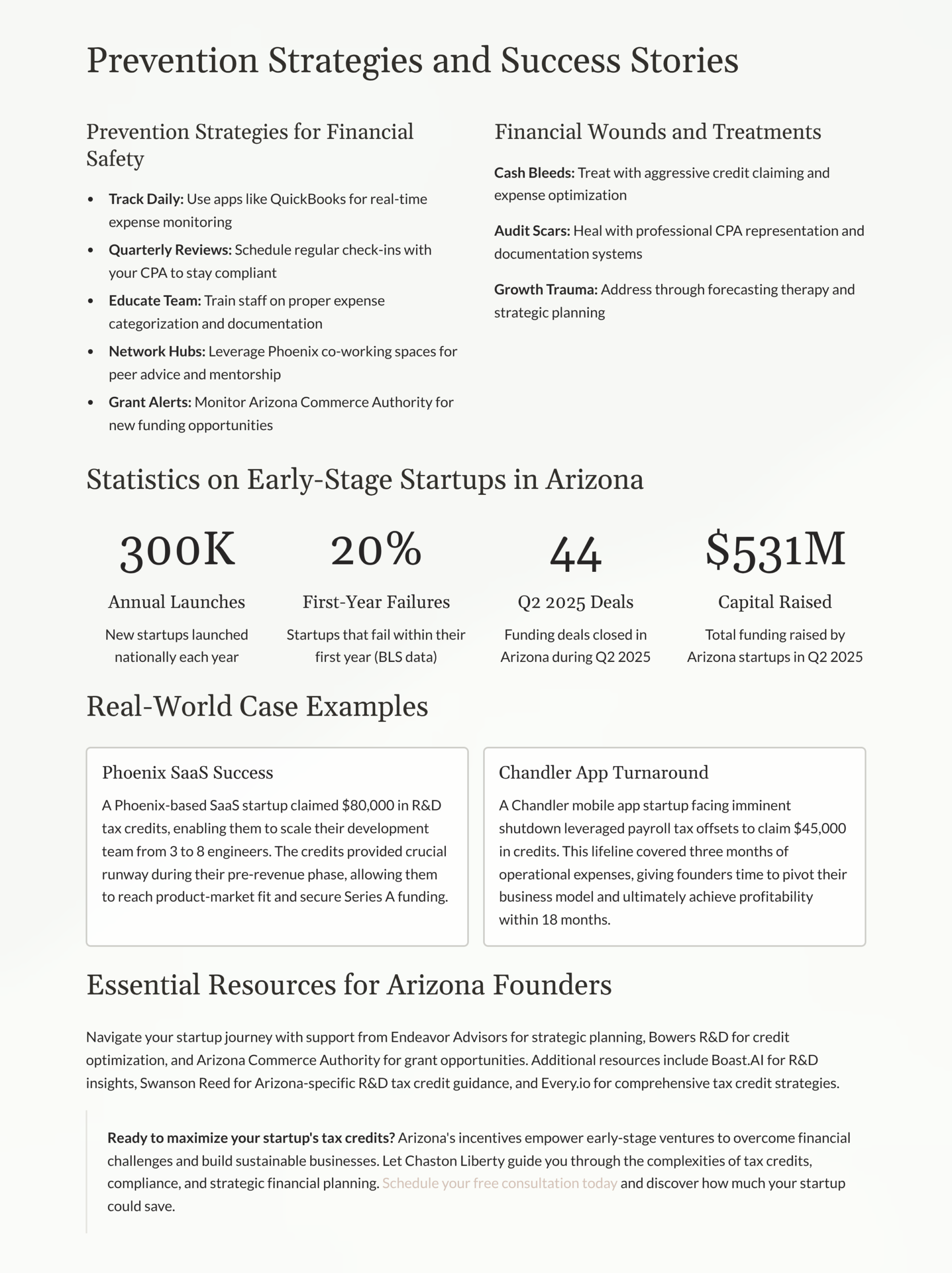

Link to Common Tax Mistakes for Startups: From Deductions to Infections. Prevention Strategies for Early-Stage Financial Safety in Arizona

- Track Daily: Use apps like QuickBooks.

- Quarterly Reviews: With CPA.

- Educate Team: On expenses.

- Network Hubs: Phoenix co-working for advice.

- Grant Alerts: AZGFD-equivalent AZ Commerce.

Every.io tips: Every.io Tax Credits AZ. Financial Wounds and Treatments for Early-Stage Startups Unique issues:

- Cash Bleeds: Treat with credits.

- Audit Scars: CPA representation.

- Growth Trauma: Forecasting therapy.

BLS startup stats: BLS Pediatric-Equivalent Failures. Statistics on Early-Stage Startups in Arizona National: 300K launches, 20% fail year one (BLS). Arizona: 44 Q2 deals, $531M (Silicon Oasis). Silicon Oasis funding stats: Silicon Oasis Arizona Funding 2025. Case Examples

- Phoenix SaaS: Claimed $80K R&D; scaled team.

- Chandler App: Offset payroll, avoided shutdown.

Ready to get started?

Contact Chaston Liberty CPA or call us at (480) 590-0968. You can also email Jim Chaston at jim@chastonliberty.com.

Let’s build a smarter tax strategy together—one that protects your business and fuels your success.